Financial Services

Protecting Financial Growth from Fraud

Protecting digital finance from credential attacks and data abuse, ensuring secure and trusted transactions.

Common Risks in Financial Services

Data Leakage

Weak password reuse lets fraudsters steal user data, build detailed profiles, and commit fraud.

Data Scraping

Malicious bots steal transaction data, exposing user privacy and enabling targeted scams.

SMS Pumping

Attackers abuse SMS OTP interfaces, sending fake requests that waste resources and increase costs.

Promotion Abuse

Bot farms exploit online campaigns to claim bonuses or rewards, draining budgets and distorting user growth.

Conversion Impact

Complex verification flows frustrate players and raise drop-off rates, hurting retention and overall user experience.

GeeTest Solution Protects Your Business

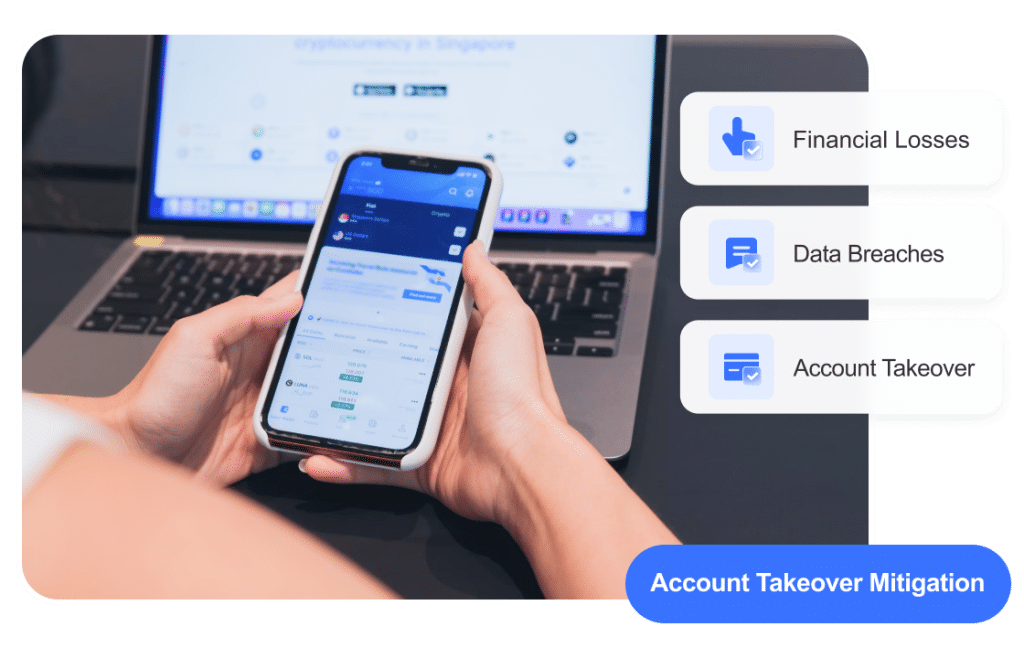

Prevent Account Takeover

GeeTest blocks bot traffic at login and registration, stopping automated sign-ups and fake accounts to protect player privacy and asset safety.

Prevent Automated Logins

GeeTest blocks automated registrations and credential stuffing attacks. By analyzing device fingerprints, behavior patterns, and login environments, it protects account authenticity and prevents unauthorized access.

Stop Data Harvesting

GeeTest identifies and blocks scraping requests from both network and application layers through dynamic traffic analysis and multi-layer models, preventing unauthorized data extraction.

Stop OTP Abuse

GeeTest analyzes user environment, behavior, and device data before SMS delivery. It intercepts suspicious requests and enables extra business rules to reduce costs, improve security, and enhance user experience.

Ensure Real User Engagement

GeeTest distinguishes human users from bots through behavioral analysis and risk profiling, ensuring marketing rewards reach genuine users and maximizing ROI.

Protect Your Business With GeeTest Network Security Tools

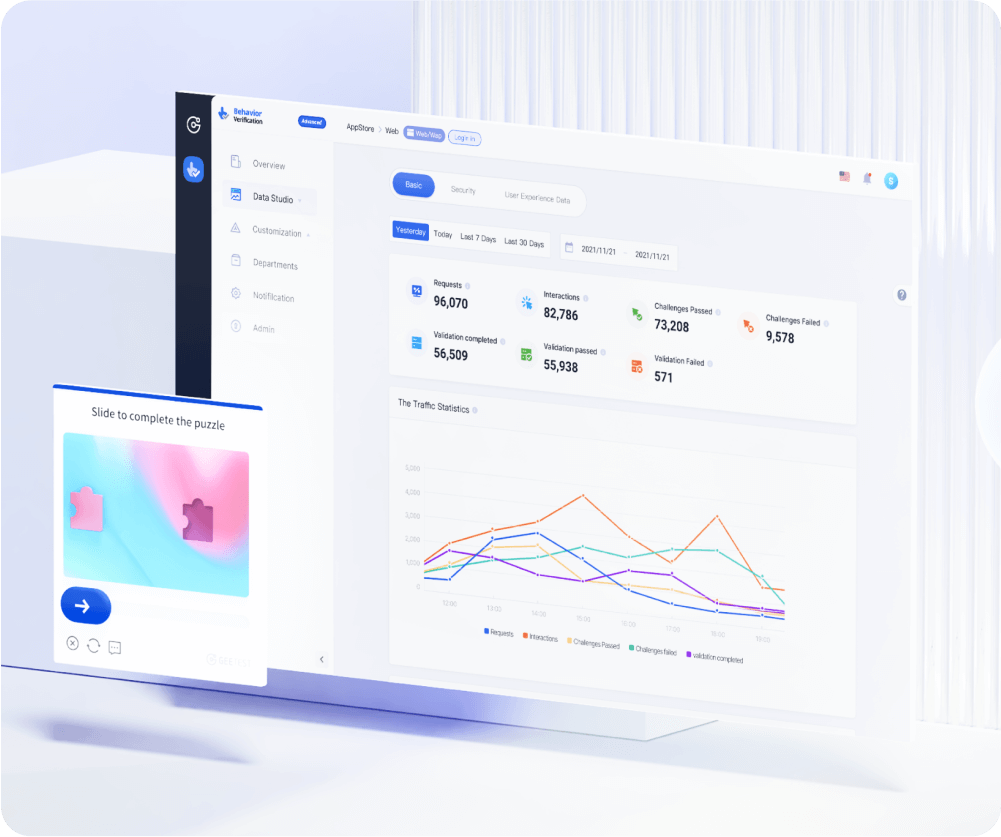

Smart defense against bot attacks

GeeTest’s newest adaptive CAPTCHA combats sophisticated bots with dynamic security and offers a customizable design for a seamless experience for enterprises and end users.

- Behavior verification enhanced by 7-layer dynamic protection.

- Optimizing conversion rate with ease-of-use design.

- Easily integrated for WEB, WAP, iOS, Android, Html5.

- Multilingual support and global deployment.

Accurate device id & risk flagging

Revolutionize device recognition with advanced algorithms, set new standards in tracking accuracy, utilize detailed risk dimensions for a holistic view of traffic patterns.

- iOS: 99.78%, Android: 98.97%, Web: 98.01% accuracy.

- Accurate account analysis & deduplication.

- Fraud detection through device and behavioral risk analysis.

- Ensure privacy by reducing reliance on private data like IMEI/IDFA.

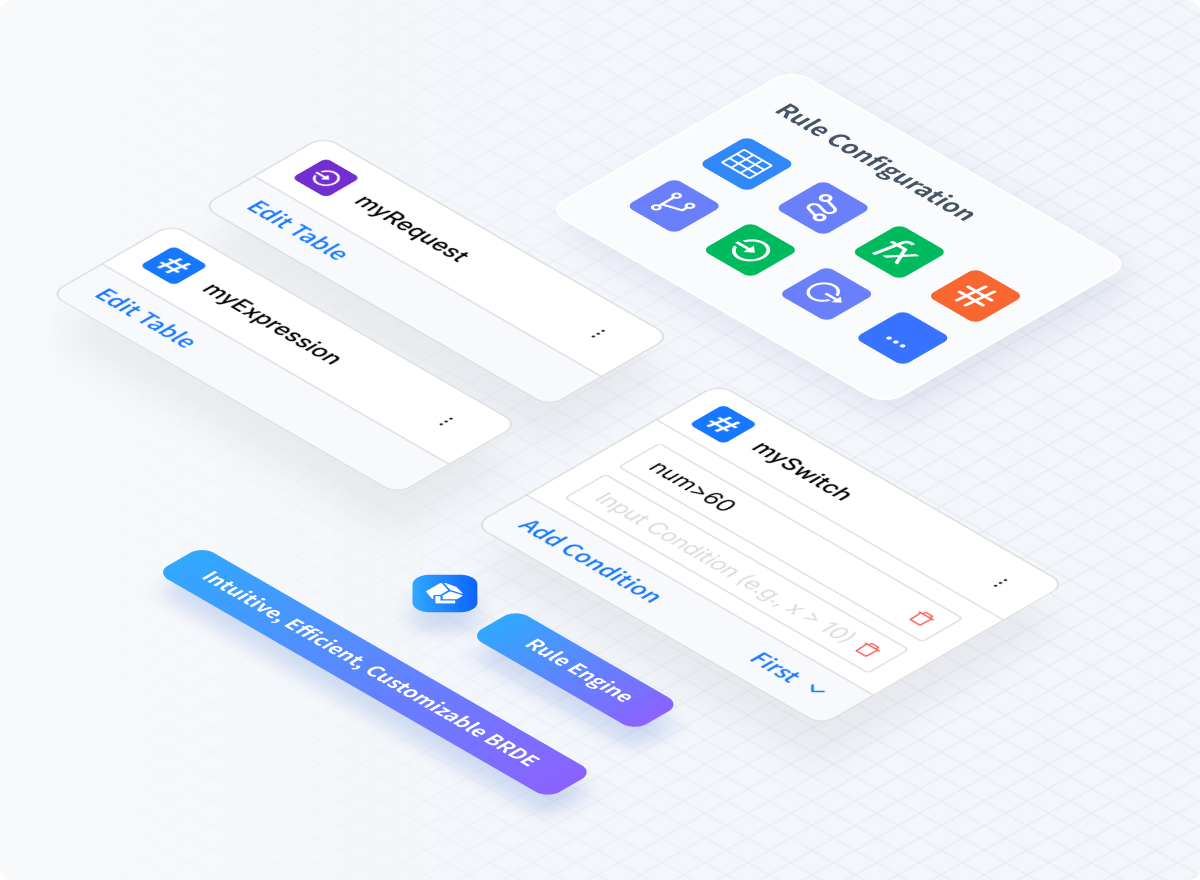

Agile decisions with business rules

Combined with the existing risk management capabilities and business rules, build a flexible, comprehensive, and automated risk control system.

- Deeply integrate with your own business rules for complex decision-making.

- Integrate existing risk control capabilities and consolidate resources.

- Flexible decision-making with dynamic adjustments.

E-commerce Industry Security

White Paper

GeeTest Adaptive CAPTCHA

White Paper

GeeTest Bot Traffic Analysis Dashboard

Ebook

GeeTest Highlights

GeeTest helps financial platforms fight fraud, block scalpers and fake accounts, and secure user experiences.

360K+ clients and 1.9B daily requests enable real-time threat awareness.

GeeTest CAPTCHA 4.0 delivers 7-layer adaptive protection with 4,374 variations per cycle.

Triple disaster recovery ensures high availability and service continuity.

Always-on response and regular data reports ensure premium service.

Protects registration, login, orders, reviews, and refunds.

Who Chooses GeeTest

Protect your business with GeeTest

Join us with 360,000+ protected domains now!